What is a Security? Using the Howey Test to Classify Assets

The SEC has previously used the Howey Test, outlined by the U.S. Supreme Court, in deciding whether something is an “investment contract” and, therefore, a security. The Howey test is one of the most important legal precedents in the history of financial regulation. It was created by the Supreme Court in its 1946 decision, SEC v. W. J. Howey Co. The test sets out factors to determine what qualifies as an investment contract, and thus a security:

1) whether there is an investment of money

2) in a common enterprise

3) with a reasonable expectation of profits from the efforts of others.

The test has been used ever since then by courts across the country to determine whether or not an asset or security falls under federal regulations such as those enforced by the Securities Exchange Commission (SEC). In its most simple form, whether something is or isn’t a security under US rules is basically a question of how much it looks like shares issued by a company raising money.

How The SEC Classifies Various Digital Assets

The future of cryptocurrency depends on its classification. If cryptocurrency is defined as a security, it falls under the jurisdiction of the SEC, and is subject to rules on price transparency, greater reporting demands, and market abuse oversight. Interestingly, the SEC does not consider Bitcoin as a security. Rather, the SEC has clearly determined that Bitcoin falls under the category of commodities as it can be considered ‘digital gold.’ Ether, the second largest digital asset by market cap, was also deemed as a commodity by a senior SEC official a few years ago. Yet, SEC Chairman Gary Gensler’s recent comments seem to leave Ethereum’s status up in the air. Ethereum’s recent switch to proof-of-stake, a system whereby validators lock up, or ‘stake’ coins in order to record transactions, could be one reason for the change of heart on the part of the SEC. Proof of Stake networks pay an interest to validators in exchange for their staked coins, a function that the SEC takes into consideration when treating a digital asset as a security.

According to comments made by SEC Chairman Gary Gensler, almost all other crypto assets fall under the securities category. Throughout the lifetime of digital assets, the SEC has preferred to regulate through enforcement. Looking at some of the cases brought by the SEC against crypto companies can give us a better understanding of how the agency views the industry. Here are four cases worth considering.

- Ripple. In December 2020, the SEC sued Ripple Labs Inc., for allegedly raising money by selling the XRP digital token without registering it as a security. The agency claimed that the company was funding its growth by issuing XRP to investors speculating that its value would rise. As the Ripple versus Securities and Exchange Commission (SEC) legal dispute inches closer to a summary judgment, the cryptocurrency industry eagerly awaits the outcome. If the court sides with the SEC, crypto exchanges will face more scrutiny from regulatory agencies and will likely have to register as securities if they continue selling within the U.S.

- LBRY. In November 2022, Judge Peter Barbadoro of the U.S. District Court for the District of New Hampshire granted the SEC’s motion for summary judgment as to whether software company LBRY, Inc. offered tokens (called “LBRY Credits” or “LBC”) in securities transactions. Among other things, Judge Barbadoro ruled that potential investors would understand that “LBRY’s overall messaging … was pitching a speculative value proposition for its digital token,” thus satisfying the expectation-of-profits clause of the Howey test.

- FTX. The agency’s unfolding case against FTX reveals arguments that could further that strategy. The SEC, in its pursuit of securities fraud charges pertaining to FTX’s sale of its native token FTT—appears to be escalating its assault on crypto assets as a whole. The complaint labeled FTT “an illiquid crypto asset security,” making the subtle—but crucial—point that the SEC views FTT as a security in itself, regardless of the manner in which it was offered or sold. By deeming FTT as a security, the SEC has set a precedent for all exchange tokens which can also find themselves potentially running afoul of the agency.

- Paxos. Cryptocurrency firm Paxos announced that it will cease issuing new BUSD stablecoins under the direction of New York state’s financial regulator. The company confirmed it had been notified by the Securities and Exchange Commission of potential charges in connection with its BUSD product. The New York State Department of Financial Services issued the order “as a result of several unresolved issues related to Paxos’ oversight of its relationship with Binance,” the regulator said in a consumer alert.

SEC tightening its enforcement grip

The U.S. Securities and Exchange Commission recently included the regulation of emerging technologies and crypto assets as one of its 2023 priorities. The SEC intends to examine whether crypto companies meet appropriate standards of care when “making recommendations, referrals or providing investment advice.”

The SEC continues to be a main regulator in the cryptocurrency space. Its actions have focused on two allegations:

(1) unregistered securities offerings

(2) fraudulent securities offerings or sales.

The SEC’s apparently increased commitment to resolving digital asset cases through litigation rather than settlement when compared to the general trend across all the agency’s enforcement actions. More scrutiny of market intermediaries, such as exchanges and broker-dealers, rather than issuers or promoters of single tokens. As such, these intermediaries may bear the brunt of any increased enforcement activity.

How INX occupies a unique position in this scenario.

Five years ago, INX entered the crypto space in a unique way. Our goal was to occupy a position in the digital economy where every aspect of their services would be conducted under US regulatory supervision. Today INX is one US regulated hub for trading and investing in cryptocurrencies & security tokens. All transactions are carried out on our proprietary and regulated platform. Both carefully-vetted cryptos and security tokens trade side-by-side on the INX One platform, including the INX token, our native security token that is registered with the SEC.

As traders and investors we recognize, and often welcome, the risks associated with speculating in the financial markets. We have also learned to eliminate risk wherever possible. At this time INX stands alone as being one regulated hub providing its clients with full SEC regulatory protection in every aspect of their trading business. This is the INX WAY!

]]>During a recent Stock Day Podcast, the host, Everett Jolly, interviewed our Deputy CEO & COO. The interview couldn’t be more timely considering the many new developments on the U.S. regulatory front with regards to crypto custody, fraud and the growing efforts to set checks and balances.

During the podcast discussion, Avneri emphasized that a solid regulatory framework is necessary to attract more mainstream investors to the digital asset industry.

Without it, he said, the wild west mentality will persist and larger institutional investors won’t fully participate in the digital finance ecosystem. With that said, however, he sees the landscape changing, especially after the fallout of behemoth crypto exchange, FTX, and the attention now turning to establishing needed guardrails.

Avneri mentioned that the crypto crash and the fall of FTX highlighted the importance of secure and regulated digital finance platforms – something that INX put in place from the very beginning by becoming the first company to get SEC approval to raise capital for its own token, the INX Token, after a long, three-year journey. At this point, it seems that not only is INX not part of the problem, but it holds the solution. Operating with checks and balances, said Avneri, is in our DNA.

The Insumer In A Tokenized Economy

Jolly asked Avneri about the future of the tokenized industry to which he responded that the future is already happening…right now. He believes that the new type of investors, called “Insumers,” want to invest in companies and products with digital assets in a regulated way.

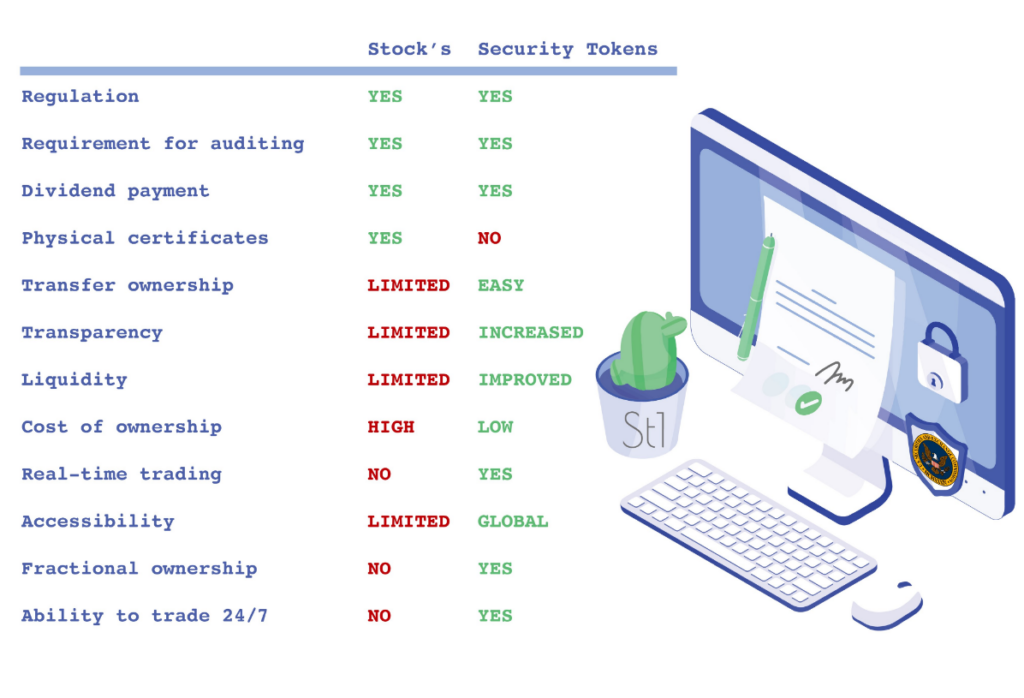

Security tokens, in particular, are a means by which businesses raise capital from interested investors, and the records they carry are immutable and easy for anyone to view—a degree of transparency that makes even traditional equities seem unnecessarily opaque.

Through the use of blockchain technology, security tokens have enabled a new order of magnitude in investing possibilities, including directly interacting with their consumers in ways not previously achievable, while expanding their pool of potential investors. Additionally, this new three-dimensional, mutually beneficial insumer/company relationship can create a sense of community that builds lasting brand loyalty and engaged investors.

A Tokenized Future With New Financial Tools

The Blockchain, and all that comes with it, represents a seismic shift in markets that will drive down transaction costs and create a tidal wave of innovation in finance. As Avneri highlighted, these innovations will benefit issuers and investors in the US and globally.

Avneri mentioned during the podcast that he sees more financial instruments being tokenized in the future, including, especially as the regulatory frameworks (pioneered by INX) evolve with the growth of digital assets – with security tokens leading the way.

Security tokens can be for public companies that are already listed on a traditional exchange, like Nasdaq, to tokenize part of their shares. Tokenization can also be used for issuing digital bonds by government and corporate entities. Additionally, the development, testing and deployment of Central Bank Digital Currency continues to grow.

Digital Assets: A Wealth Of Opportunities

The conversation between Everett Jolly and Itai Avneri was eye-opening to listeners who maybe aren’t as familiar with security tokens and digital assets, and reassuring to those who are but are still skeptical about the future where these assets exist in a safe and regulated environment. The key is that this future exists now thanks to the work of Itai and the team at INX. The company’s vision set the standard others are now using to work with regulators and deploy blockchain-based solutions that continue to move the digital economy forward in a positive way.

]]>What is a security?

A security is any type of financial instrument that holds some tangible monetary value. Any security is only worth what a buyer and seller agree it’s worth. Indeed, most people think of stocks—an equity stake in a publicly traded company—when they think of securities. While stocks are historically the principal example of a security, they are not alone. A bond is a security. As is an exchange-traded fund.

Even within the world of stocks, not all stocks are created equal. Most people think of public stocks that trade on exchanges like the Nasdaq when thinking about stocks. Yet, there are certain securities that are technically considered stocks in companies but are not publicly traded on Nasdaq, NYSE or any other major stock exchanges. These securities can be stocks in companies that raised capital through a registration-exempt offering.

From a legal perspective in the US, a security is defined as any asset that meets the four requirements set out in the Supreme Court ruling on the SEC v. W.J. Howey Co. case in 1946. Known as ‘the Howey Test,’ the ruling determined that a security is any asset which involves:

An investment of money

An investment of money

In a common enterprise

In a common enterprise

An expectation of profits

An expectation of profits

From the effort of others

From the effort of others

While the Howey Test remains the standard for defining securities in the US, its applicability was challenged by the rise of digital assets, a new class of instruments built on blockchain technology. Nevertheless, the SEC made it clear that no adjustments to the Howey test would be forthcoming for tokens, and token issuers would need to comply with existing securities laws like everybody else.

What is a token?

In the context of blockchain, a token is a digital asset or unit of value that is created and managed using blockchain technology. Tokens can represent a variety of things, such as a specific asset, a share in a company, or a form of cryptocurrency. Not only can tokens represent ownership in an asset of sorts, but they can also function as unique identifiers used for authentication and verification. One of the key advantages of tokens is the fact that they are programmable, allowing for the automation of functions like dividend distribution and voting rights.

Combining the Best of Tokens With the Best of Securities

Security tokens typically function using smart contracts, which are self-executing digital contracts that automatically enforce the terms of the token. These contracts can include provisions for things like dividend payments, voting rights, or even buyback options, and are designed to help ensure that the token operates in a fair and transparent manner.

Central to the smooth functioning of security tokens is a new class of token standards that are purpose-built to comply with regulation. A token standard is basically a set of characteristics that determine how new tokens should be created. Instead of having to create tokens from scratch, developers can adapt a specific token standard for their own use case. In the case of security tokens, the ERC-1404 token standard bakes compliance into the token by making it impossible for someone that has not verified themselves to send or receive the token.

Overall, security tokens offer a new way for investors to access a wide range of assets while also benefiting from blockchain technology’s transparency, security, and efficiency

What is a Security Token Offering (STO)?

Companies looking to raise capital can leverage digital assets by holding a security token offering (STO) in which they offer their token to the investing public. Raising capital through token offerings was first popularized during the Initial coin offerings (ICO) boom as many companies discovered the ease with which they could raise money by issuing tokens to the public. While ICOs

An STO requires a significant amount of pre-compliance preparation. Anyone can start an ICO and participate (unless their local laws say they can’t). However, in order for a company to offer an STO, they need to do it under a valid exemption or regulation so it can then be traded on a regulated platform.

Advantages of a Security Token Offering (STO) Over Traditional Fundraising Methods

- Security tokens enable retail investors to invest in privately-owned companies and assets not listed on public stock exchanges, democratizing finance.

- Security tokens allow firms to launch global STOs, attracting investors from untapped sources and facilitating liquidity for long-dated private markets.

- Fractionalization of securities allows more investors to participate in previously restrictive markets, improving overall depth and level of activity.

- Security tokens introduce instant settlement and 24/7/365 secondary markets, unlocking liquidity and increasing efficiency for investors.

- Programmatic compliance is facilitated by smart contracts built into security tokens, limiting potential fraud and misappropriation of funds by incorporating compliance requirements such as KYC and AML checks, profit sharing, voting rights, and bankruptcy protection clauses.

Introducing Digital Asset Regulation

What separates security tokens from other digital asset classes is the fact that security tokens are subject to various securities law. Around the world, different countries are taking different approaches to regulating security tokens and digital assets in general. In the US, SEC Chairman Gary Gensler believes almost all tokens are considered securities, and therefore must comply with existing regulations, and that only Bitcoin can be considered a commodity that falls outside the SEC’s jurisdiction.

It’s crucial that token issuers consider the regulatory implications of offering a security before launching. According to the law, any company that wants to offer a security must either register for an initial public offering with the SEC, or take advantage of one of the SEC’s registration exemptions. Since the full IPO is too costly and time-consuming for most companies, many choose to go the route of an exemption such as Reg D and Reg S.

A Word on Terminology

A recent op-ed in CoinDesk tried to draw a distinction between security tokens and tokenized securities, a distinction we believe is out of place. According to Noelle Acheson, security tokens refer to crypto tokens with security characteristics, such as revenue share or voting rights, whereas a tokenized security is a digital representation of a classical security, such as stock or bond. In our view, this distinction is unnecessary. Any token that is compliant with securities law can be called both a security token and a tokenized security. In fact, the distinction between revenue-sharing security tokens and tokenized securities, stocks and bonds on the blockchain, overlooks the fact that security tokens combine the best of both traditional finance and blockchain technology. The stocks and bonds of the future are likely to have additional functionality powered by smart contracts, while the tokens of the future are likely to adhere to securities law like stocks and bonds.

Security Tokens The INX Way

Ever since INX issued the first SEC-registered security token in history, we have been heads-down helping businesses launch their own compliant tokens and list them for trading on our US-regulated exchange. From launching your token, to investor due diligence and cap table management, we have everything you need to raise capital through a security token offering.

Discover STOs with us by visiting our Raise page.

]]>Below are the five core benefits of raising capital through a security token offering.

- Enabling retail capital flow

Security tokens provide an opportunity for retail investors to invest in assets that are not listed on the public stock exchanges, thereby allowing for investments, and in effect, equity in privately-owned companies. Thanks to security tokens, asset classes like early-stage ventures that were traditionally open only to accredited investors only can now be made available, under certain SEC regulations, to accept f retail capital flow. Not only does this contain the potential for bringing trillions of dollars into private markets, but also allows retail investors to access these markets which goes a long way in democratizing finance.

- Unlocking global liquidity

With the right kind of compliance, firms can launch global STOs in the future, attracting investors from all over the world. Companies would be able to raise capital from previously untapped sources. This truly levels the playing field in allowing equal opportunities for all investors, as opposed to previous restrictions based on “who you know”.

Private markets are generally known to be long-dated, meaning they lock up investors’ money for a long time period before they have an opportunity to sell, if at all. By introducing security tokens to private markets, investors can have an opportunity for liquidity inr their equity positions that previously did not exist.

- Fractionalizing ownership

Traditionally, markets for certain high-value assets find very few participants due to the high costs of entry. Commercial real estate and art are both excellent examples of such restrictive markets. With the tokenization of these assets, more investors can be attracted to these markets, improving their overall depth and level of activity. By dividing up securities into fractions, small investors can buy securities directly from issuers, which presents a great opportunity for them to invest in up-and-coming companies, or assets with long-term opportunities, and thereby positioned to benefit from their potential increase in value in the early stages of the company. As a result of fractionalization, private markets can now have many individual investors taking part, who will in turn have the opportunity to participate at the early stages.

3. Introducing instant settlement

Even in this digital age, it takes stock exchanges up to two days to process the sale of shares. Bond trades can take even longer. During the waiting period, there is a material risk involved with waiting for your counterparty to settle the trade. Just as email and instant messaging replaced postal letters, security tokens can replace traditional shares. With blockchain technology, exchanges can process transactions in a matter of minutes. Slower transactions can drastically affect parties involved in a sale, particularly sellers. For instance, a delayed real estate sale could potentially reduce the price, imposing a sort of liquidity penalty on the property owner. With real estate security tokens, we have smoother, faster sales, unlocking liquidity and allowing for substantially shorter wait times for entering as well as exiting the market.

- 24/7/365 secondary markets

Security tokens allow previously-illiquid VC investments to trade on secondary markets. VCs no longer have to wait years until the startups they invest in go public or are acquired to see a return. Instead, VCs can trade in and out of positions on liquid secondary markets should they require capital, or should their investment thesis change. It’s not just the VC market that stands to gain from a transition to tokenization. Traditional markets follow a strict office schedule, closing in the evening and on weekends. This hampers the ability of investors to make moves in time to capitalize on changes in the market. Moreover, it is a highly inefficient system. With blockchain technology, future security token markets can stay open and operational 24/7/365.

- Programmatic compliance

The ability to automate control for compliance with security laws since tokens allow for building compliance requirements into the token. Smart contracts facilitate built-in features that can be designed case-specific to include rights, obligations, and compliance provisions that inherently become instilled in the agreement. This can include provisions such as KYC (know your client) and AML (anti-money laundering) checks. Profit sharing, voting rights, and even bankruptcy protection clauses can all be written into smart contracts, thereby limiting potential fraud and misappropriation of funds.

Tokenizing the Right Way, The INX Way

As advocates of the digital revolution, it seemed an obvious decision for INX to create its own token. In 2019 INX announced the filing for its own security token offering, which started trading on July 28th, 2021. INX token was the first SEC-regulated token to IPO on the blockchain. Today INX offers an end-to-end service for issuers as well as investors. From internal due diligence, through pre-issuance, to SEC registration, creating your personalized token and ultimately listing the token on INX’s regulated ATS for trading.

Our team of experts is there to guide you through the entire process, including tokenomic design, guidance with SEC registration, a capital raising platform and token issuance. Once the token is live, we also provide cap table management and secondary market trading for your token on the INX alternative trading system (ATS.) All under one roof. All in one place. All under SEC regulation.

Investors have made it clear that the three most important features to be considered in financial investments are trust, transparency, and regulatory protection. Security Tokens on INX checks off all 3!

For more information, visit our raise page.

]]>From The Dark Web to Davos: The Evolution of Digital Assets

Since their development a few short years ago, digital assets have rapidly grown in popularity. Initially, they only held sway amongst tech-savvy individuals who sought their use as a store of value, with the help of exchanges on the Dark Web. The infamous marketplace known as the Silk Road was the venue for a majority of cryptocurrency activity until it was shut down in 2013, and its founder was thrown into jail for life.

Since then, the rising popularity of Bitcoin, Ethereum, and other blockchain projects has transformed digital assets from a shady corner of the internet into a viable asset class. Every day sees an influx of institutional money entering the space, making digital assets much easier for the average investor to access. Public companies such as MicroStrategy and even countries like El Salvador are investing in cryptocurrencies such as Bitcoin.

Meanwhile, digital assets in the form of security tokens are having a major impact on capital markets and the way companies raise money. As technology continues to advance and the financial industry evolves, digital assets are increasingly playing a significant role in the capital markets. One of the most notable developments in this space has been the rise of security tokens, which are digital assets that represent ownership in a company or an investment fund. These tokens use blockchain technology to securely track and transfer ownership, making them more efficient and transparent than traditional methods. This shift is having a profound impact on the way companies raise money and access capital.

With security tokens, companies have a new, innovative way to access funding, which is changing the traditional landscape of capital markets. This trend is expected to continue and gain momentum as more and more companies adopt this new class of digital assets.

The rise of digital assets has been so significant that they featured heavily in this year’s World Economic Forum in Davos, Switzerland. This event brings together the world’s most influential leaders in business, politics, and academia to discuss the most pressing issues of the day. The inclusion of digital assets in the discussion is a testament to their growing importance in the global economy.

How Digital Asset Regulation is Shaping Up In the USA

The US position atop the digital asset universe was cemented when China introduced a ban on crypto mining, driving plenty of activity in the direction of the United States. Yet, not all activity in the US has been positive, with the collapse of FTX and the arrest of its former CEO having a particularly negative impact on the crypto industry’s reputation with some regulators and politicians. SEC Chairman Gary Gensler has been particularly vocal about the risks of cryptocurrencies, and that many of them fall under the definition of unregistered securities.

In fact, Gensler is adamant that of all crypto assets out there, only Bitcoin can be considered a commodity and by extension, falls outside the SEC’s jurisdiction. In addition, the SEC has made it clear that token issuers can’t expect new regulation any time soon, and must instead abide by the existing SEC playbook like any other company raising capital. Companies wishing to issue tokens must either file a full prospectus or register for one of the SEC’s private placement exemptions such as Reg A+, Reg S, Reg D or Reg CF.

SEC commissioner Hester Pierce spoke about the agency’s plans to allow investors to “ trade crypto security tokens versus or alongside crypto non-security tokens” at the Digital Asset Conference at Duke, a conference at which INX spoke as well.

Digital Asset Regulation Around the World

While the US continues to lead the pack, the digital assets revolution is global in nature, evolving differently across a number of jurisdictions worldwide.

In Australia, regulators are determined to figure out how to implement stablecoins into the national payment ecosystem safely. A paper published by the Reserve Bank of Australia lays out a framework for stablecoins and considers risks such as climate-related impacts, disruptions to funding markets, and liquidity risks that might arise from their use. Cryptocurrency is legal in Australia and is considered property for capital gains tax purposes. The Australian government has implemented regulatory measures to monitor cryptocurrency transactions and prevent illegal activities, such as money laundering and terrorist financing.

In the United Kingdom, the Financial Conduct Authority (FCA) has taken a proactive approach to regulation by establishing guidelines for firms involved in crypto-related activities, including anti-money laundering and consumer protection measures. Additionally, the FCA considers security tokens to fall under the scope of the ‘Regulated Activities Order (RAO). UK Prime Minister Rishi Sunak is a vocal proponent of crypto and digital asset innovation and even ordered the British Royal Mint to issue an NFT when he was Finance Minister.

In Europe, steps to introduce a clear regulatory framework for the industry gave rise to the Fifth Anti-Money Laundering Directive (5AMLD), a law passed in 2020 aiming to improve the prevention of money laundering and terrorist financing in the context of virtual assets. Additionally, the European Securities and Markets Authority (ESMA) has assumed responsibility for regulating security tokens, which it classifies as “those classes of securities which are negotiable on capital markets, with the exception of instruments of payment.”

In South Korea, a crypto-friendly president, Yoon Suk Yeol, assumed office in May of last year. Recently, the country introduced legislation to bring security tokens under the scope of capital market rules. South Korea is famous for its innovation-first mindset and population, over 10% of which own some form of digital assets. This latest push to regulate security tokens is already sparking awareness amongst a vast mainstream audience.

In Central and South America, El Salvador remains the leader in mainstreaming Bitcoin, with President Nayib Bukele announcing a new BTC investment strategy and Economy Minister Maria Luisa Hayem Brevé introducing a bill to raise $1 billion for a “Bitcoin city.” Brazil has also become pro-crypto with the introduction of a bill to legalize crypto as a payment method.

In Africa, the regulatory status of digital assets varies by country. Some countries have taken a cautious approach to regulation, while others have been more supportive of the growth of digital assets. For example, in South Africa, the central bank has issued guidelines for cryptocurrencies, while in Kenya, mobile money has driven innovation in digital financial services. In Nigeria, the central bank has issued warnings about cryptocurrencies, but they are still widely used. Overall, the regulatory environment for digital assets in Africa is still evolving, and more clarity and consistency will emerge in the coming years.

What Does the Future Hold for Digital Asset Regulation?

As digital assets continue to gain popularity and momentum, regulators around the world are working to establish clear and consistent guidelines. The aim is to provide a framework that balances investor protection, market stability, and innovation. At INX we have been striving to comply with all relevant regulations since day one, and welcome the increased awareness that’s being generated in the digital asset space. Magic happens where innovation meets regulation, and that’s where we’ll continue to be.

]]>What compliant routes can companies take to raise money through security tokens?

Security tokens and the entire digital asset space are fairly new, and as such, regulation continues to evolve around the world. In the United Stares, the SEC has made it clear that tokens are no different than any other asset in that they will be classified as a security if they meet the criteria set out in the Howey Test. According to the Howey test, any investment contract that contains an expectation of profit from the efforts of others could be classified as a security. The SEC has made it clear on a number of occasions that most tokens are actually securities.

Therefore, it’s important for potential token issuers to understand the paths they can take to offer compliant security tokens. One way to do so is by registering for a full public offering with the SEC, which involves publishing a full prospectus and adhering to strict disclosure requirements and ongoing reporting. Going for a full IPO is a costly endeavor for small and mid-sized companies, as it involves substantial legal, accounting, and reporting expenses.

That’s where registration-exempt offerings come in. Companies can take advantage of the various SEC exemptions to issue tokens and raise capital from retail and institutions without having to go through the entire IPO process. Two of the more commonly used exemptions are Reg D and Reg S.

What is a Reg D Exemption?

“Reg D” refers to Regulation D of the U.S. Securities and Exchange Commission (SEC), which provides exemptions from the registration requirements of the Securities Act of 1933 for certain types of offerings of securities. In other words, it provides a way for companies to raise capital without having to register their securities with the SEC.

The most commonly used exemptions under Reg D are Rules 504, 505, and 506. These rules allow companies to offer and sell securities to “accredited investors” (generally, wealthy individuals) without having to register the securities with the SEC. The rules also impose limitations on the amount of investors in the offering and the type of investors who may participate.

What is a Reg S Exemption?

“Reg S” refers to Regulation S of the U.S. Securities and Exchange Commission (SEC), which provides exemptions from the registration requirements of the Securities Act of 1933 for certain offerings of securities outside the United States. Reg S is designed to allow companies to offer and sell their securities to foreign investors without having to register the securities with the SEC under a Reg ‘S’ offering,

What do you need to do a Reg S or Reg D token offering?

Securities offerings held under the Reg S or Reg D exemptions are known as private placements. Before undertaking a private placement, potential issuers should have two key documents prepared, a private placement memorandum (PPM) and a subscription agreement.

A private placement memorandum (PPM) is a detailed disclosure document that provides potential investors with important information about the company, the offering, and the risks involved in investing in the securities being offered. The PPM typically includes information such as the company’s business plan, financial statements, the terms and conditions of the offering, the use of proceeds, a description of the risks associated with investing in the securities being offered and other crucial disclosures.

A subscription agreement is a legal contract between an investor and a company that outlines the terms and conditions of a private placement of securities. It typically includes information such as the type and number of securities being purchased, the purchase price, the payment terms, the delivery date, and any restrictions on the transfer of the securities.

It’s important to note that composing both a PPM and a subscription agreement involves legal complexities and should be done with the help of legal counsel.

Innovation Meets Regulation

In just over a decade, digital assets have evolved from the fringes of the internet to become a bona fide asset class and the flag bearers for the next frontier of finance. Forward-thinking companies are discovering the potency of raising capital through security token offerings, which combine the best of digital and traditional finance. Business owners looking to leverage security tokens must be well-versed in the regulatory framework in which they operate. INX is proud to operate at the forefront of digital asset regulation and to share our expertise with potential security token issuers.

]]>What is the Metaverse?

The term ‘metaverse’ was first coined by Neil Stephenson to refer to an immersive digital experience in his 1992 book ‘Snow Crash.’ 30 years later, the metaverse has grown from a sci-fi curiosity into a dominant theme thanks to the rapid progress in the technologies that make it all possible. The metaverse blends together cutting-edge technologies, most notably virtual reality, augmented reality, blockchain, and artificial intelligence, to create a fully-immersive web. Virtual and augmented reality technologies provide the visual and auditory elements that make the metaverse feel real and tangible. Blockchain-based digital assets allow users to own property of value in the metaverse, such as plots of virtual land or gaming avatars. Additionally, characters within the metaverse can be made responsive and intelligence with the use of artificial intelligence is used to provide intelligent and responsive virtual characters.

While the hype surrounding the metaverse has grown tremendously in recent years, the concept is not new. Second Life, a popular virtual world that has been around since 2003, allows users to create their own avatars and participate in a variety of activities such as shopping, attending events, and playing games. However, the surge of investment and interest in the metaverse is a recent phenomenon, driven by both the maturing of technology and social habits formed during the COVID-19 pandemic. Today, people across the globe are accessing virtual worlds through a variety of devices, even buying up assets in metaverses such as Sandbox.

The Origins of The Sandbox Metaverse

One of the leading platforms within the metaverse is Sandbox, which provides users with experiences ranging from simple gaming to multi-dimensional social interaction. Co-founded in 2012 by Arthur Madrid, who is the company’s CEO, and Sébastien Borget, who is the COO, Sanbox initially started as a mobile game. Animoca brands acquired Sandbox in 2018 and set about transforming it into a full-fledged metaverse platform that combines gaming and social experiences with blockchain technology.

The basis of the Sandbox universe is the map of Lands offered for sale. Players can purchase land to build a variety of engaging activities using Sandbox’s game maker. Not only can players create a virtual experience for the Sandbox metaverse, but they can monetize their creations, by earning rewards for their work, selling in-game items, and staking tokens. The Sandbox Shop contains countless user-generated assets available for sale, from

What is the SAND Token and How Does It Impact the Metaverse?

The SAND token serves as a form of digital currency within Sandbox – the main currency of Sandbox’s metaverse. It is used to make purchases in the marketplace, pay fees for services, and reward players for taking part in various game-related activities. The SAND token’s value is driven by its use within Sandbox’s virtual world and has quickly become an integral part of gameplay.

The SAND token is also used to purchase land and other virtual assets within the metaverse. This allows players to build and customize their own virtual worlds, creating unique experiences for themselves and others. Additionally, the SAND token can be used to purchase in-game items, such as weapons, armor, and other items that can be used to enhance the gaming experience. By using the SAND token, players can create a truly unique and immersive experience within the metaverse.

How to Get Started with Sandbox and the SAND Token

In order to access and use Sandbox’s metaverse, users must first register by creating an account. Once inside the game, users can then acquire SAND tokens in order to purchase items, access services or acquire rewards for their performance. Players can buy SAND tokens on INX in three simple steps:

1) Create and verify an account: In order to start trading on INX you’ll first need to create an account and verify your identity using our hassle-free process:

2) Fund your account: You have an account, now it’s time to fund it. There is no minimum investment amount, so you can get started with any amount that makes you comfortable.

3) Place your SAND order: Using the INX One, you can instantly purchase SAND and enter the metaverse in a safe, secure way.

Once users have obtained enough SAND tokens for their desired activities, they can begin their journey in the metaverse by playing various games or creating interactive stories.

In addition to playing games and creating stories, users can also explore the metaverse and discover new places, meet new people, and take part in various events. They can also use their SAND tokens to purchase virtual goods, such as clothing, furniture, and other items, to customize their avatar and make it unique. With the SAND token, users can also purchase access to exclusive content, such as special events, tournaments, and other activities.

Challenges Facing Metaverse Mass Adoption

The metaverse is a relatively new concept and, as such, there are still numerous challenges that must be overcome before mass adoption can occur. Many users are hesitant to fully immerse themselves in virtual worlds due to privacy and security concerns. Safety measures need to be put in place to ensure that players’ data and interactions remain secure so that they feel safe exploring these online universes.

Additionally, platforms like Sandbox need to continue developing user-friendly tools to ensure that no matter how complex the concepts may be behind them, anyone can access them without encountering major difficulties. If development teams continue to raise awareness about all the advantages the metaverse offers and successfully eliminate the potential hazards that might arise when interacting with this technology, we may eventually see mass adoption of this groundbreaking new way of playing and interacting online.

A Whole New World

The world as we know it is changing in ways few could have imagined just a few years ago. Digital living, and ownership, will become a growing part of human existence as the technologies underpinning the metaverse continue to evolve. By purchasing SAND on INX, newcomers and experts alike can enter the metaverse in a safe, secure and exciting way.

Get your SAND tokens on INX today.

The emergence of Ethereum

Although the Ethereum blockchain has several founders, Vitalik Buterin was the one who initially published a white paper explaining the concept of Ethereum in November 2013. Following Buterin’s initial work, other brains jumped on board in various capacities to help bring the project to fruition.

Ethereum gained awareness in early 2014 when Buterin brought the concept of the blockchain project into the public eye at a Bitcoin conference in Miami, Florida. The project raised capital via an initial coin offering (ICO) later the same year, selling millions of dollars worth of ETH in exchange for funds to use for the development of the project. Between July 22 and Sept. 2, 2014, the asset sale sold over $18 million worth of ETH, paid for in Bitcoin.

Although ETH coins were purchasable in 2014, the Ethereum blockchain did not actually go live until July 30 2015, meaning ETH buyers had to wait for the blockchain to launch before they could move or use their ETH.

Ethereum is a decentralized blockchain platform that establishes a peer-to-peer network that securely executes and verifies application code, called smart contracts. Smart contracts allow participants to transact with each other without a trusted central authority. https://cointelegraph.com/ethereum-for-beginners/history-of-eth-the-rise-of-the-ethereum-blockchain

What are smart contracts?

A smart contract is a computer program that facilitates the exchange of any asset between two parties. It could be money, shares, property, or any other digital asset that you want to exchange. Anyone on the Ethereum network can create these contracts. The contract consists primarily of the terms and conditions mutually agreed on between the parties (peers).

The smart contract’s primary feature is that once it is executed, it cannot be altered, and any transaction done on top of a smart contract is registered permanently—it is immutable. So even if you modify the smart contract in the future, the transactions correlated with the original contract will not get altered; you cannot edit them.

The verification process for the smart contracts is carried out by parties in the network without the need for a centralized authority, and that’s what makes any smart contract execution on Ethereum a decentralized execution.

Ethereum’s Merge to Proof of Stake

Central to the operation of smart contracts is consensus mechanism by which transactions get validated and added to the ledger. From inception, Ethereum’s consensus mechanism was similar to Bitcoin’s Proof of Work. In September 2022, Ethereum made the transition from a power-hungry, proof-of-work system to an environmentally friendly proof-of-stake system. This switch is known as the “merge.”

The merge was triggered by Ethereum’s mainnet hitting “terminal total difficulty,” a predetermined point at which ETH mining became effectively impossible. In a Proof of Work mechanism, “miners” race to solve hard math problems using huge amounts of computing power and are rewarded for their efforts in crypto. That approach consumes a lot of energy. It also posed scaling challenges for Ethereum: network congestion drove up fees and slowed down processing rates, making the network too expensive for smaller transactions and hard to scale for larger ones. Proof of stake, on the other hand, requires “validators” to put up a stake—a cache of ether tokens in this case—for a chance to be chosen to approve transactions and earn a small reward. The more a validator stakes, the greater the chance of winning the reward.

Tokenomics of Ethereum

Ethereum’s merge had major ramifications on the token economy of the network, specifically the nature of validators and how they get rewards. As defined by Ethereum.org, a validator is a node in a proof-of-stake system responsible for storing data, processing transactions, and adding new blocks to the blockchain.

To participate as a validator, a user must deposit 32 ETH into the deposit contract and run three separate pieces of software: an execution client, a consensus client, and a validator. On depositing their ETH, the user joins an activation queue that limits the rate of new validators joining the network. Once activated, validators receive new blocks from peers on the Ethereum network. The transactions delivered in the block are re-executed, and the block signature is checked to ensure the block is valid. The validator then sends a vote (called an attestation) in favor of that block across the network.

Whereas under proof-of-work, the timing of blocks is determined by the mining difficulty, in proof-of-stake, the tempo is fixed. Time in proof-of-stake Ethereum is divided into slots (12 seconds) and epochs (32 slots). One validator is randomly selected to be a block proposer in every slot. This validator is responsible for creating a new block and sending it out to other nodes on the network. Also in every slot, a committee of validators is randomly chosen, whose votes are used to determine the validity of the block being proposed.

Ethereum has an unlimited supply with no maximum. At the time of writing, there are 122 million ETH in circulation. As blocks are validated, more Ether is added to the ecosystem. This is the opposite of Bitcoin, which has a maximum supply of 21 million.

There’s no specific Ethereum supply cap, which means the total number of coins in circulation will continue to increase for as long as people mine the blockchain. It’s also noteworthy that Ether’s supply has stood relatively still since September 2022. The Daily Block Rewards maintaining at 7,100 blocks.

According to the explanation on the Ethereum coin limit shared by Vitalik Buterin, it’s only possible to mine 18 million ETH coins per year. This equates to around 2 ETH being mined per block in the Ethereum blockchain.

Ethereum added 129,869 new unique addresses daily in the first month of 2023.

Indeed, on January 1, 2023, Ethereum had 217,599,463 unique addresses, whereas, on January 29, 2023, the number of Ethereum unique addresses was 221,365,692, indicating that ETH gained 3,766,229 between the two dates.

Ethereum in 2023

Price action in ETH/USD has displayed drastic swings and volatile price action since its early days. The price traded in a relatively narrow range between $150 and $350 from 2018 until late in 2020. In May 2021 the currency reached a high of $4300, and by November we saw new highs of $4800! Following the dark days of last year’s crypto winter, the price crashed to below $900. After a strong start to 2023, the price is sitting above the $1600 level at the start of February 2023. From a technical analysis perspective, the short-term target for buyers will be the $2000 mark, which is shaping up to be a pivotal area.

The Smart Contract Wars: Ethereum Competitors

Besides Bitcoin (BTC), Ethereum (ETH) has been the most influential blockchain in crypto’s history. Since its launch in 2015, the price of Ethereum’s native ether token has remained the second-largest cryptocurrency by market cap. Ethereum developers have also introduced dozens of revolutionary Web3 innovations to the crypto space, including NFTs (non-fungible tokens), smart contracts, and dApps. Although Ethereum remains the dominant blockchain for dApp developers, it is not without its flaws.

High network fees and slow transaction speeds have hindered Ethereum’s mass adoption. Sensing this weakness, dozens of competing blockchains have promised to “replace” Ethereum with superior features. Since ETH is no longer the only game in town, there are some noteworthy competitors in this space.

– Solana (SOL) can process more transactions per second with much lower transaction fees than most rival blockchains, such as Ethereum. It has blazing fast speed as well as low fees. It can post smart contracts and has a low environmental impact. Users can also stake Solana (SOL) for rewards.

– Algorand (ALGO) is a digital currency as well as a blockchain platform meant to quickly handle multiple transactions. It is considered a direct rival to Ethereum since it can host other cryptocurrencies and blockchain-based initiatives.

– Avalanche (AVAX) is a cryptocurrency and blockchain platform. AVAX is the native token of the Avalanche blockchain, which—like Ethereum—uses smart contracts to support a variety of blockchain projects. The Avalanche blockchain can provide near-instant transaction finality.

– Binance Smart Chain is a sovereign smart contract blockchain delivering Ethereum Virtual Machine (EVM) compatible programmability. Designed to run in parallel with Binance Chain, Binance Smart Chain retains the former’s fast execution times and low transaction fees while adding Smart Contracts functionality to support compatible dApps.

Ethereum, alongside Bitcoin and Dogecoin, is one of those cryptocurrencies that are well-known even outside of the crypto community. And it is for a good reason — Ethereum is one of the most feature-rich and interesting blockchains out there.

Is it better to buy Ethereum or Bitcoin?

Ultimately, the debate between Bitcoin and Ethereum as investments comes down to an investor’s risk profile. Both have the potential to perform well over time as the world continues its shift to digital and cryptocurrencies acceptance grows. Bitcoin is the more established and mainstream of the two, which may make ETH just a touch riskier?

As with most investments, it’s possible Ethereum’s higher risk brings with it potential for higher rewards. In either case, it’s not 2009 anymore: Both currencies have sprinted past the proof-of-concept phase and it’s now time for risk-tolerant investors who have not yet considered this asset class in the past to stand up and take notice.

Want to buy Ethereum? Sign up for INX!

]]>What is CBDC?

Central bank digital currencies or CBDCs are digital currencies issued and backed by central banks, offering the stability and security of traditional currency with the efficiency and convenience of digital technology. Central banks are exploring the possibility of introducing CBDCs in order to increase financial inclusion, boost access to payment systems, and reduce transaction costs associated with traditional cash and card payments. As the global financial landscape continues to evolve and digital technology becomes increasingly ingrained in our lives, CBDCs have the potential to revolutionize the way we use and exchange money.

Already in the design phase of CBDCs, we find many governments, central banks, and technologists draw the distinction between retail CBDCs and Wholesale CBDCs. Retail CBDCs are designed for use by the general public and are meant to function like physical currency, serving as a medium of exchange for everyday transactions. They are usually accessible to the general public through digital wallets and can be used to pay for goods and services. On the other hand, Wholesale CBDCs are designed for use by financial institutions and are meant to settle large-value transactions between banks. These CBDCs are used in interbank settlements and are not accessible to the general public.

Understanding the Benefits of CBDC

One of the primary advantages of CBDCs is their potential to increase financial inclusion. By providing citizens with access to digital accounts, central banks can give people direct access to the banking system, enabling them to make transactions in a simple and secure way. This could be particularly helpful for people in developing countries who lack access to traditional financial institutions. Additionally, CBDCs could help lower administrative costs associated with transferring money, making it easier and faster for people to complete transactions.

CBDCs could also reduce the risk of fraud. All transactions are recorded on a digital ledger that is updated in real-time, making it difficult for criminals to access data or conduct illicit activities. Furthermore, central banks have the ability to track and trace all funds, which could make financial crime easier to detect and deter.

In addition, CBDCs could provide a more efficient way to store value. By using a digital currency, individuals and businesses can avoid the costs associated with traditional banking services, such as fees for transferring money or exchanging currencies. This could make it easier for people to save and invest their money, leading to greater economic stability.

Challenges Holding Back Adoption of CBDC

With great power comes great responsibility, and there is arguably no greater power in the hands of central banks than the ability to control the money supply. By shifting to digital currency, central banks and governments gain an unprecedented level of transparency and control over the lives of their citizens. As all transactions are recorded on a digital ledger, there are concerns about the level of transparency involved and individuals’ privacy rights. Not only can the government see each and every transaction in real-time, but they can also enforce policy directly. For example, a government could theoretically bar certain people from buying luxury goods, or travel tickets, with their CBDCs.

Privacy concerns could explain why the countries that have already launched CBDCs are failing to incentivize citizens to adopt their digital currencies. For example, only 0.5% of Nigerians use the e-Naira CBDC. At the same time, interest in Bitcoin and cryptocurrency continue skyrocketing in Nigeria. The Bahamas, which has also issued a CBDC known as ‘the Sand Dollar’, also has a low rate of adoption with less than 8% of citizens using CBDCs. It seems like central banks and governments are going to have to work hard to get their citizens to adopt CBDCs

CBDCs Vs Decentralized Cryptocurrencies: Four Key Differences

CBDCs and cryptocurrencies share similar technological characteristics in that they both run on blockchain, but in many ways, the two asset classes are totally different. Below are four of the key distinctions between CBDCs and cryptocurrencies:

- Issuance and Control: Cryptocurrencies are issued by a decentralized network of miners that anyone can join. On the other hand, CBDCs are issued by central banks, which tightly control the entire lifecycle of their currencies.

- Transparency and Access: While anyone can view the history of transactions associated with cryptocurrencies on a block explorer, only banks and other privileged institutions can gain such wide-ranging access to audit the transaction history of CBDCs.

- Privacy and Anonymity: CBDCs can be designed to allow for some degree of privacy, but transactions are still traceable and subject to regulation by central authorities. Decentralized cryptocurrencies, on the other hand, often prioritize privacy and offer more anonymity to users.

- Security: The security of CBDCs is tied to the security of the central authority issuing them, while the security of decentralized cryptocurrencies is tied to the decentralized network that maintains and validates the transactions. Decentralized cryptocurrencies can be more resistant to hacking and other security breaches, but the complexity of the technology may also make it less accessible to the general public.

Despite their differences, the new digital economy is shaping up to include both CBDCs and cryptocurrencies living co-existing, and thriving on regulated platforms. Along with security tokens, CBDCs, and cryptocurrencies have a primary place in the finance of the future and form a key component of our long-term vision at INX.

INX Blazing The Trail for CBDC Together with Swiss Giant SICPA

INX is proud to lead the charge toward a prosperous digital economy by building across the spectrum of digital assets. To realize our vision for CBDC, INX partnered with SICPA, a company that has served as a long-trusted partner to governments and central banks around the world. INX and SICPA will work side-by-side to establish innovative CBDC solutions for central banks, assisting clients in boosting their economies and monetary sovereignty. Together, the combined team will raise the bar in delivering innovative approaches to key requirements issued by central banks and their ecosystems, like compliance, scalability, cross-border transactions, and programmability.

]]>What is Turncoin?

Turncoin is a digital company which is the world’s first trading platform for backing talent. Turncoin derives its value from a real-life practical global application of blockchain technology called VirtualStaX. It pays out 100% of the available global gross revenues of TheXchange (the VirtualStaX Ecosystem) in USDC to Turncoin holders as a pro-rata monthly yield.

VirtualStaX are digital trading cards that allow people in all passions of life to showcase their talents on a global stage and give friends, family and their global fan base the opportunity to buy VirtualStaX in them, participate in their journey and share in their success.

How Does it Work?

VirtualStaX are blockchain-verified digital trading cards for talented individuals that fans can buy, sell, trade, and collect on TheXchange (StaX.app) . VirtualStaX opens up a new stream of potential income for talented individuals based on their performance. Professionals can use it as an opportunity to monetize their popularity, and amateurs can have an avenue to fund their dreams by allowing fans worldwide to participate in their journey, access premium content, and share in their success

StaX Issuers (aka the talents) can register their own StaX in categories like sports, music, art, entertainment, influencers, inventors, celebrities, and more. As an investor, you do not have to have the talent to enjoy the profits of talent.

To date Turncoin has been backed by big names in sports and entertainment like Cam Jordan, Drew Brees, Luke Bryan, Patrick Mahomes.

A Wealth of Opportunities on INX

INX has recognized the talent and is proud to announce the first fan economy security token offering: Turncoin (TXC).

This week, INX is enabling Turncoin’s (TXC) $70M digital security primary capital raise, which is available to U.S. accredited investors and all non-U.S. investors, including retail and institutional investors.

The very essence of Turncoin’s tokenization is based on the talents and potential successes of those afforded the opportunity to be recognized. Any person, across the globe, that has the passion to make a difference in their own special way is a potential Issuer of their own token. The blockchain-verified digital trading cards entitles fans to buy, sell, trade, and collect on TheXchange (StaX.app)

This is the opportunity to invest in a human start-up that revolves around talent. Talented individuals looking for the opportunity to share their worth, and talented investors that recognize that talent.

To invest in Turncoin, visit here

]]>